Market Overview at a Glance

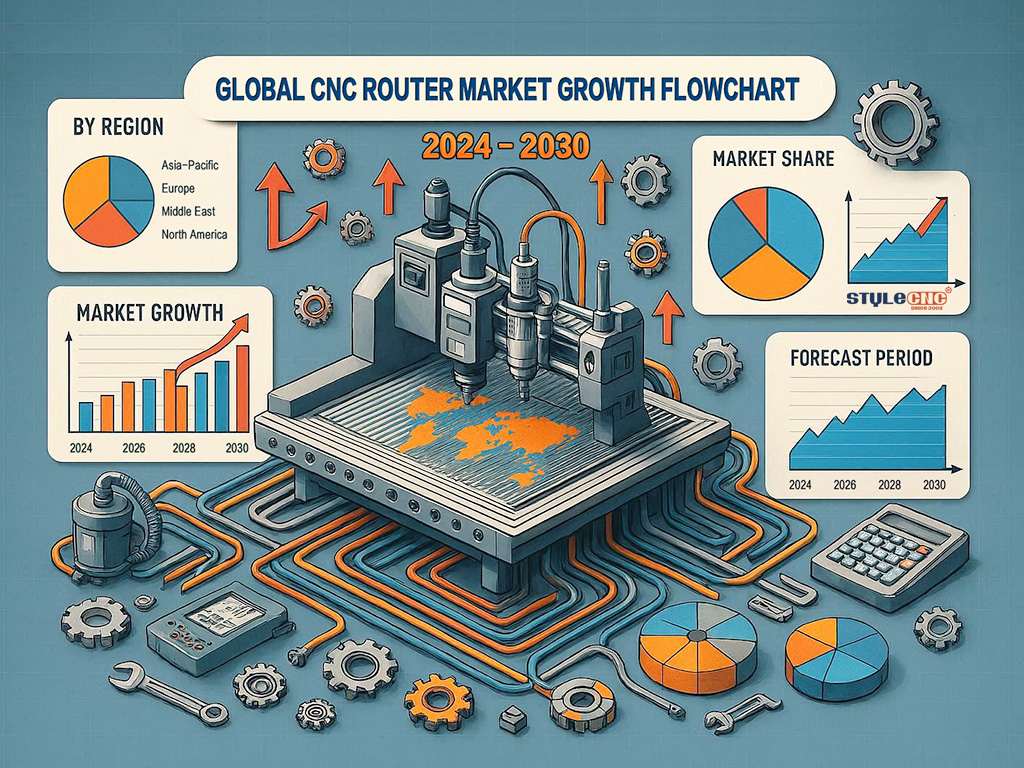

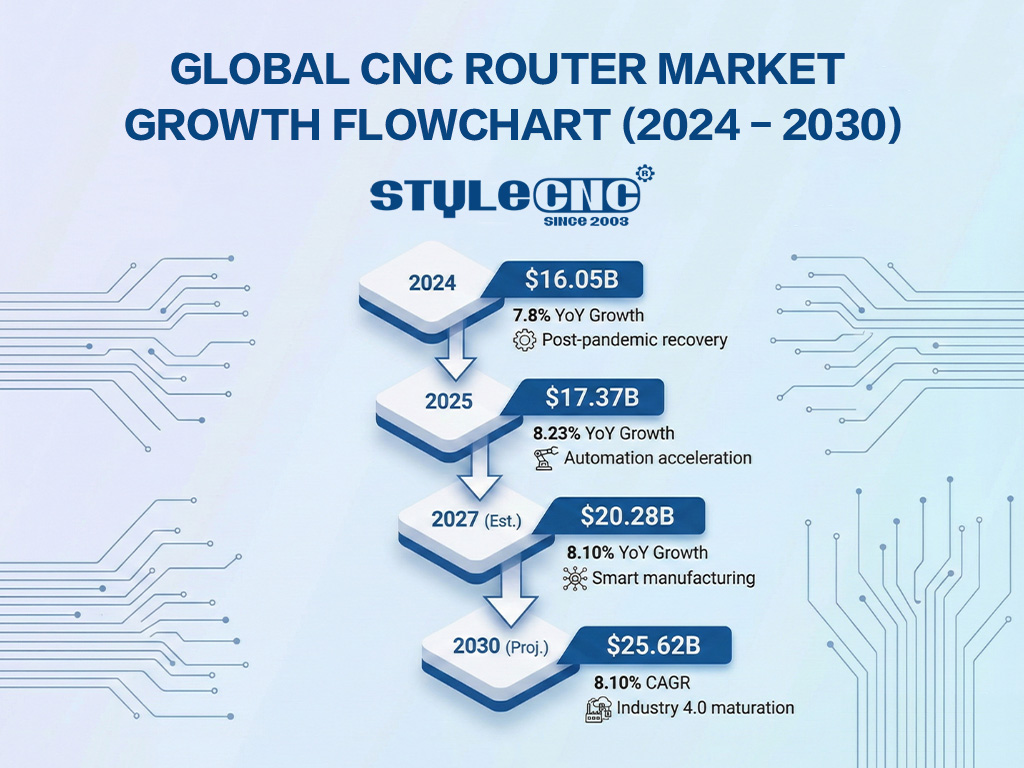

The global CNC router market grew from $1១៥ កោដិក្នុង 2024 ទៅ $1១៥ កោដិក្នុង 2025, representing an 8.23% year-over-year increase. The market is projected to reach $25.62 billion by 2030, expanding at a compound annual growth rate (CAGR) of 8.10%. Primary growth drivers include automation adoption across manufacturing sectors (60% of growth), demand for customized products in furniture and automotive industries (30%), and hybrid CNC machine adoption (10%).

The computer numerical control router industry stands at a pivotal moment in its evolution. Driven by unprecedented demand for precision manufacturing, sustainable production methods, and the global push toward Industry 4.0 adoption, CNC carving technology has transitioned from specialized equipment to essential manufacturing infrastructure across diverse sectors.

This comprehensive market analysis examines the forces reshaping the industry, identifies emerging opportunities across regional markets, and provides actionable insights for manufacturers, investors, and end-users navigating this rapidly evolving landscape. Our analysis draws from verified industry data, manufacturer reports, and direct market intelligence gathered across major manufacturing hubs worldwide.

Current Market Valuation and Growth Trajectory

How big is the CNC router market?

The global CNC router market reached $1១៥ កោដិក្នុង 2025. North America accounts for approximately 15.1% of the market share, Asia-Pacific leads with over 40% of global demand, and Europe represents roughly 25% of total market value.

The market expansion reflects fundamental shifts in manufacturing philosophy rather than cyclical demand fluctuations. Over 45,000 new CNC router units ship annually across multiple end-use industries, with woodworking, signage, metal fabrication, composites processing, and plastic manufacturing driving consistent demand growth.

Small and medium enterprises represent an increasingly significant buyer segment. Modern hobby CNC routers and entry-level machines have democratized access to precision manufacturing capabilities, enabling small workshops and individual entrepreneurs to compete with established production facilities on quality while maintaining cost competitiveness.

Historical and Projected Market Size

| ឆ្នាំ | តម្លៃទីផ្សារ | ការលូតលាស់ YoY | កម្មវិធីបញ្ជាគន្លឹះ |

|---|---|---|---|

| 2024 | $ 16.05B | 7.8% | ការងើបឡើងវិញក្រោយជំងឺរាតត្បាត |

| 2025 | $ 17.37B | 8.23% | Automation acceleration |

| ២២ (ប៉ាន់ស្មាន) | $ 20.28B | 8.10% | ផលិតកម្មឆ្លាត |

| ២០៣៣ (គម្រោង) | $ 25.62B | 8.10% CAGR | Industry 4.0 maturation |

Industry Segmentation and Application Analysis

Understanding demand distribution across industries reveals where growth opportunities concentrate and which segments drive market expansion. The woodworking sector remains the dominant application, though emerging segments demonstrate accelerating adoption rates.

Market Share by Industry Segment

| ឧស្សាហកម្ម | ចែករំលែក | កម្មវិធីបឋម | អត្រាកំណើន |

|---|---|---|---|

| ឈើ។ | 39.8% | Furniture, cabinetry, millwork | 5.8% CAGR |

| ការប្រឌិតលោហៈ | 27.4% | យានអវកាស គ្រឿងបន្លាស់រថយន្ត | 6.4% CAGR |

| ប្លាស្ទិក និងសមាសធាតុ | 15.2% | Signage, displays, prototypes | 7.2% CAGR |

| Stone Processing | 9.8% | តុបញ្ជរ, វិមាន | 4.9% CAGR |

| ឧស្សាហកម្មផ្សេងៗ | 7.8% | Electronics, education, R&D | 8.5% CAGR |

សិប្បកម្មឈើ និងគ្រឿងសង្ហារិម

The woodworking segment maintains market leadership through continuous innovation in customization capabilities. Modern រ៉ោតទ័រ CNC ឈើ enable manufacturers to produce bespoke furniture pieces at near-mass-production efficiency, addressing the growing consumer preference for personalized home furnishings.

ទំហំធំ បន្ទាត់ផលិតកម្មគ្រឿងសង្ហារឹម increasingly integrate CNC carving with automated material handling, nesting optimization software, and real-time quality monitoring. These integrated systems reduce material waste by up to 15% while increasing throughput by 40% compared to traditional manufacturing approaches.

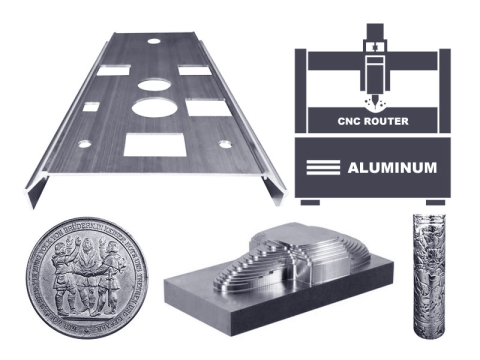

Metal Fabrication and Aerospace Applications

Metal cutting applications demonstrate the fastest growth trajectory within the CNC router market. Dedicated ម៉ាស៊ីន CNC ដែក serve the aerospace, automotive, and defense sectors where precision tolerances and material properties demand specialized machining capabilities.

The electric vehicle transition has particularly accelerated demand. Lightw8 aluminum components for battery housings, motor mounts, and structural elements require high-volume precision machining that CNC routers deliver cost-effectively. Major automotive manufacturers report 25-30% increases in CNC router procurement specifically for EV component production.

Technology Trends Reshaping the Industry

What are the major CNC router technology trends?

The 5 dominant technology trends include: (1) IoT connectivity for real-time monitoring, present in 22% of new units; (2) AI-driven path optimization reducing cycle times by 15-20%; (3) hybrid additive/subtractive manufacturing capabilities; (4) automatic tool changers now standard on mid-range machines; and (5) energy-efficient designs meeting sustainability mandates.

IoT Integration and Smart Manufacturing

Connected CNC routers represent the fastest-growing technology segment within the market. Approximately 22% of new machines now ship with embedded cloud connectivity modules enabling remote diagnostics, predictive maintenance alerts, and real-time production monitoring. Manufacturers implementing connected router fleets report 15-20% reductions in unplanned downtime through predictive maintenance capabilities.

Multi-Axis Machining Advancement

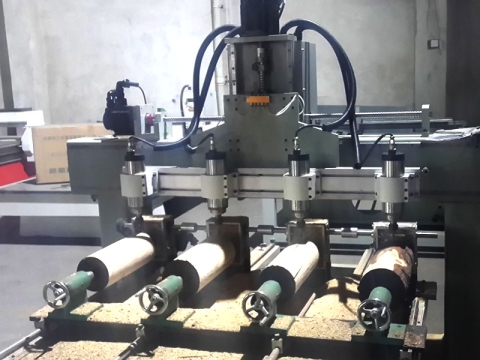

The 3 and 4-axis CNC router segment currently holds approximately 66.5% market share, valued at $254.61 million. However, រ៉ោតទ័រ CNC 4 អ័ក្ស និង 3D រ៉ោតទ័រ CNC with 5-axis capabilities are expanding at 4.8% CAGR, significantly above the overall market rate, as aerospace and automotive applications demand complex geometry machining.

Automatic Tool Changer Adoption

Production environments increasingly require រ៉ោតទ័រ ATC CNC that automatically swap between different cutting tools during operation. These systems reduce operator intervention, enable lights-out manufacturing, and improve overall equipment effectiveness by eliminating manual tool change delays. Data indicates that approximately 9% of routers now ship with pallet automation modules, with ATC penetration significantly higher in production-focused segments.

ការវិភាគទីផ្សារក្នុងតំបន់

Geographic demand patterns reveal distinct market characteristics shaped by industrial development stages, regulatory environments, and sector-specific requirements. Understanding regional dynamics enables manufacturers and buyers to optimize market positioning and purchasing strategies.

| តំបន់ | ចែករំលែក | CAGR | អ្នកបើកបរសំខាន់ | Leading Sectors |

|---|---|---|---|---|

| អាស៊ីប៉ាស៊ីហ្វិច | 40%+ | 9.2% | Rapid industrialization | គ្រឿងសង្ហារិម គ្រឿងអេឡិចត្រូនិច |

| អឺរ៉ុប | ~ 25% | 6.8% | Industry 4.0 adoption | រថយន្ត, យានអវកាស |

| អាមេរិកខាងជើង | 15.1% | 7.13% | Reshoring, automation | លំហអាកាស, ការពារ |

| ពាក់កណ្តាលភាគខាងកើត | ~ 5% | 8.4% | ការធ្វើពិពិធកម្មសេដ្ឋកិច្ច | Construction, interiors |

អាស៊ីប៉ាស៊ីហ្វិក៖ ម៉ាស៊ីនកំណើន

Asia-Pacific dominates global CNC router demand, accounting for over 40% of new installations. China leads regional growth through government-supported manufacturing modernization programs, including Made in China 2026, while India's Production Linked Incentive scheme accelerates automation adoption across furniture and automotive sectors.

Regional manufacturers leverage established component ecosystems to maintain competitive pricing while matching international quality standards. This combination of affordability and capability positions Asia-Pacific manufacturers as increasingly significant players in global export markets.

North America: Precision and Reshoring

The United States market demonstrates robust demand driven by aerospace, defense, and automotive sectors requiring high-precision machining capabilities. Reshoring trends have prompted significant capital investment in domestic CNC infrastructure, with manufacturers reducing overseas supply chain dependencies by building internal production capacity.

Key Growth Drivers and Market Forces

• Automation Demand (60% of growth): Rising labor costs and efficiency requirements drive automation adoption across manufacturing sectors

• Customization Economy (30%): Consumer preference for personalized products in furniture, automotive, and consumer goods

• Hybrid Machine Adoption (10%): Multi-function CNC systems combining carving with additive manufacturing or other cutting methods

• Construction Recovery: Post-pandemic construction activity is driving demand for architectural millwork and custom cabinetry

• EV Manufacturing: Electric vehicle component production requiring precision aluminum machining at scale

Market Challenges and Constraints

Despite strong growth fundamentals, several factors constrain market expansion. High initial capital investment remains the primary barrier for small business adoption, with approximately 28% of potential buyers citing cost concerns. Skilled operator shortages affect an estimated 14% of installations, particularly in developing markets where training infrastructure lags equipment availability.

Integration complexity with existing CAD/CAM ecosystems consumes 20-30% of project implementation time, creating friction against faster adoption. Interoperability issues affect approximately 11% of installations, especially when retrofitting CNC routers into production lines using legacy software systems.

Investment Outlook and Strategic Opportunities

Investment flows increasingly target high-growth segments, including hybrid routers, smart connectivity platforms, and composite material carving capabilities. Over 30 funding rounds targeted CNC startups in Asia and North America during the previous year, with institutional capital prioritizing firms adding IoT capabilities, AI path optimization, and modular tool changer features.

Aftermarket services represent a significant and growing revenue stream. Service contracts, spare parts supply, preventive maintenance programs, and training services generate approximately 20% recurring revenue per installed base, an attractive margin profile drawing manufacturer focus toward lifecycle revenue models.

ទស្សនវិស័យទីផ្សារអនាគត

The CNC router market's trajectory toward $25.62 billion by 2030 reflects a fundamental manufacturing transformation rather than cyclical expansion. As Industry 4.0 principles mature from concept to standard practice, CNC routers function increasingly as connected nodes within integrated production ecosystems rather than standalone machines. រុករកពេញលេញ STYLECNC ផលិតផល to identify solutions aligned with emerging market requirements.

Manufacturers positioning for sustained growth should prioritize IoT readiness, energy efficiency, and software ecosystem compatibility. Buyers evaluating CNC router investments should consider the total cost of ownership, including connectivity infrastructure, training requirements, and upgrade pathways alongside initial equipment costs.

ការយកសំខាន់ៗ

• Global CNC router market: $17.37B (2025) → $25.62B projected (2030) at 8.10% CAGR

• Woodworking leads applications (39.8% share); metal fabrication growing fastest (6.4% CAGR)

• Asia-Pacific dominates demand (40%+ share) with 9.2% regional growth rate

• IoT connectivity is present in 22% of new units; predictive maintenance is reducing downtime by 15-20%

• Automation demand (60%), customization economy (30%), and hybrid machines (10%) drive growth

• Service and aftermarket revenue generates 20% recurring revenue per installed base

សំណួរដែលសួរជាញឹកញាប់

How big is the global CNC router market and how fast is it growing?

The global CNC router market is valued at $1១៥ កោដិក្នុង 2025, ឡើងពី $1១៥ កោដិក្នុង 2024, an 8.23% year-over-year increase. The market is projected to reach $25.62 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.10%. This growth is driven by automation demand (60%), customization trends (30%), and hybrid machine adoption (10%).

Is a CNC router worth it for a small business in 2026?

Yes, a CNC router is worth it for small businesses if production volume justifies the investment. Entry-level machines ($2,000-$8,000) typically pay for themselves within 6-18 months through labor savings and increased output. The key factors are: daily usage hours, product margins, and whether you need multi-tool operations. Businesses running 4+ hours daily see the fastest ROI. The market shows 32% of SMEs adopted automation in the past year, specifically to reduce labor costs and improve consistency.

Which industries are driving the CNC router market growth?

5 industries drive CNC router market growth: Woodworking leads with 39.8% market share (furniture, cabinetry, millwork). Metal fabrication follows at 27.4% share with 6.4% CAGR, the fastest-growing segment, driven by aerospace and EV manufacturing. Plastics and composites hold 15.2% (signage, displays). Stone processing accounts for 9.8% (countertops, monuments). The remaining 7.8% includes electronics, education, and R&D applications.

What's driving CNC router prices up, and is now a good time to buy?

CNC router prices are influenced by 3 factors: component costs (steel, electronics), shipping/tariffs, and technology upgrades (IoT, ATC systems). Despite 8-12% price increases on some models, now is a strategic buying time because: (1) manufacturers offer more entry-level options than ever, (2) the used market has quality machines from businesses that upgraded, and (3) financing options have expanded. The market's 8.10% CAGR suggests prices will continue rising, so delaying increases your eventual cost.

What CNC router features matter most for ROI in 2026?

The 5 features with the highest ROI impact are:

(1) Automatic Tool Changer (ATC) reduces downtime 30-50% on multi-tool jobs.

(2) The vacuum hold-down table eliminates clamping time and improves consistency.

(3) IoT connectivity, present in 22% of new machines, enables predictive maintenance, reducing downtime by 15-20%.

(4) Dust collection integration protects machine longevity and operator health.

(5) CAD/CAM software compatibility, a poor software match wastes 20-30% of project time. Prioritize ATC and vacuum table for production; IoT and software for efficiency.